Market sounding

It is important that during the market sounding process the disclosing market participant as well as the person receiving the market sounding, comply with the legal requirements. Market soundings are interactions between a seller of financial instruments and one or more potential investors, prior to the announcement of a transaction, in order to gauge the interest of potential investors in a possible transaction and its pricing, size and structuring.

This reader’s guide is written in order to offer a legal tool to the different market participants that are involved in the market sounding processes.

Reader’s guide

This reader’s guide has an informative character. No rights may be derived from it and hence no action should be based solely on its contents. If the text deviates from the MAR, the wording of the MAR prevails.

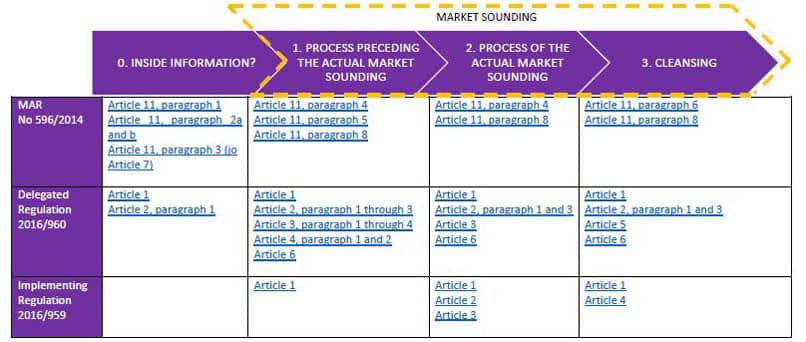

Scheme 1 - Disclosing Market Participant (DMP)

Look at the PDF for these links

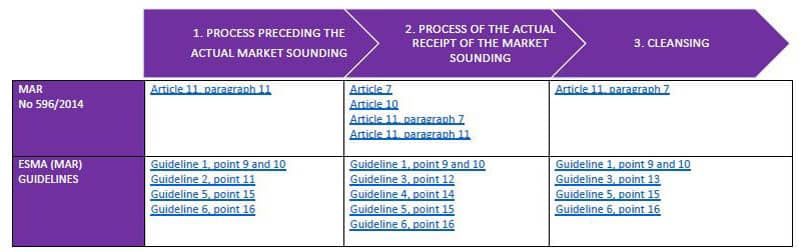

Scheme 2 - Person receiving market sounding (MSR)

Look at the PDF for these links