Supervisory Review & Evaluation Process (SREP)

In 2021, new guidelines were adopted for investment firms, including the EBA ESMA Guidelines on SREP (the EBA ESMA Guidelines). They reflect the requirements of the IFR/IFD. In the Netherlands, the IFR/IFD requirements also apply to management companies of collective investment schemes and UCITS management companies that are also licensed to provide investment services.

The EBA ESMA Guidelines stipulate that supervisory authorities regularly draw up integrated risk profiles for investment firms.

No account was taken of the Netherlands’ twin-peaks supervisory model when the European guidelines were developed. As a result, the supervisory authority’s mandate with respect to SREP is now divided between DNB and the AFM. Companies can expect information requests from both supervisory authorities in this regard.

The AFM is responsible for conduct-of-business supervision in the Netherlands’ financial markets. The requests for information thus focus on topics such as conduct & culture, governance, management, internal control, (operational) risk management and risk strategy, remuneration policy, asset segregation, the Money Laundering and Terrorist Financing (Prevention) Act (Wwft) and the Sanctions Act 1977 (Sw), PARP, outsourcing, ICT risks and Business Continuity Management (BCM). Based on its mandate, the AFM is also responsible for monitoring (and supplying) all non-financial indicators such as signals and complaints.

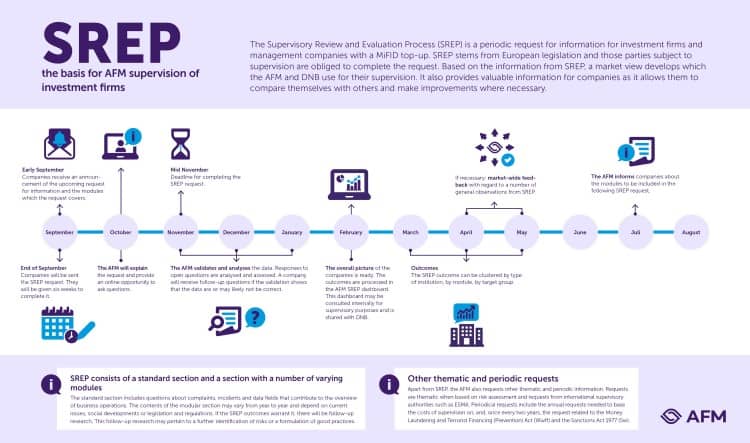

Annual AFM SREP request in focus:

Click image to download a high-res image